The Ultimate Guide to Bitcoin

Learn more about the Greatest Wealth Creation opportunity since the dotcom boom

Chapter 1:

The meteoric rise of Cryptocurrency: Bitcoin, Ether and more

Chapter 2:

Why the Banking & Financial sectors are directly to blame for the rise of Cryptocurrency

Chapter 3:

Benefits of Bitcoin & why everyone from Millennials to Boomers is excited

Chapter 4:

Bitcoin Essentials

- How to Buy & Trade Bitcoin

- What determines the value of Bitcoin

- What affects the Price of Bitcoins

Chapter 5:

Retirement & Bitcoin

- How Bitcoin can prevent a Retirement Crisis

- 3 Reasons

- A bit of caution

- FAQ

Chapter 1:

Bitcoin Explodes & The Meteoric Rise of Cryptocurrency

Since its launch in early 2009, Bitcoin for the longest time was merely a blip on the tech radar – known only to a few and cared about by even less. Fast forward a decade and Bitcoin is the poster child for Cryptocurrency – a veritable juggernaut. It’s also the driving force behind an entire ecosystem of peer-to-peer trade that includes Futures, Options, ETFs and Self Regulated Bitcoin IRAs. Traders and the general public are slowly waking up to the reality that Cryptocurrencies are mainstream and are happening right now!

There are plenty though who are still on the fence about Crypto’s growing influence within the world of traditional finance. To them, I would say look no further than the futures markets that debuted on the 10th of December 2017. As of this writing, two of the largest futures exchanges in the world are trading Cryptocurrency – the Chicago Mercantile Exchange (CME) and Cboe Global Markets, with the NASDAQ futures set to roll out in early 2018. It’s worth pointing out that, unlike traditional Cryptocurrency purchases made by individuals, wherein a person buys and holds onto currency in digital wallets, both exchanges let traders get exposure to Crypto price movements without having any actual currency i.e. minus the wallet.

The efforts of the exchanges notwithstanding, Cryptocurrency truly has come of age. Where low liquidity and a lack of infrastructure once made for wary investors, today new platforms like LedgerX and tZero are revolutionizing the system and bringing Cryptocurrency to the masses. These developments and more like it are good news for ‘ordinary’ investors since it reduces risk and allows currencies like Bitcoin to work on a grand scale. Also with regulated trades, Cryptocurrencies can achieve the volume and liquidity level needed to be attractive to big institutional investors.

Lastly, the most well-known proof of Cryptocurrencies mainstream appeal is the huge price increase that Bitcoin and few other currencies experienced towards the end of 2017. According to financial experts, all the factors that I’ve outlined above – the futures, the increasing number of investment options and the advancements in blockchain based finance came together like a perfect storm and drove the prices up to unheard of levels – taking most traditional traders by surprise.

One could argue that Cryptocurrencies are riding on a wave of advances in regulation, technology and new financial systems and architecture. This is without a doubt a goldmine for the casual investor as more Cryptocurrency and blockchain based investment choices are available now than ever before. It’s a unique once-in-a-generation opportunity for wealth creation that absolutely is worth exploring along with other more traditional investment opportunities.

Chapter 2:

The ‘why’ behind the surge and what the mainstream news won’t tell you

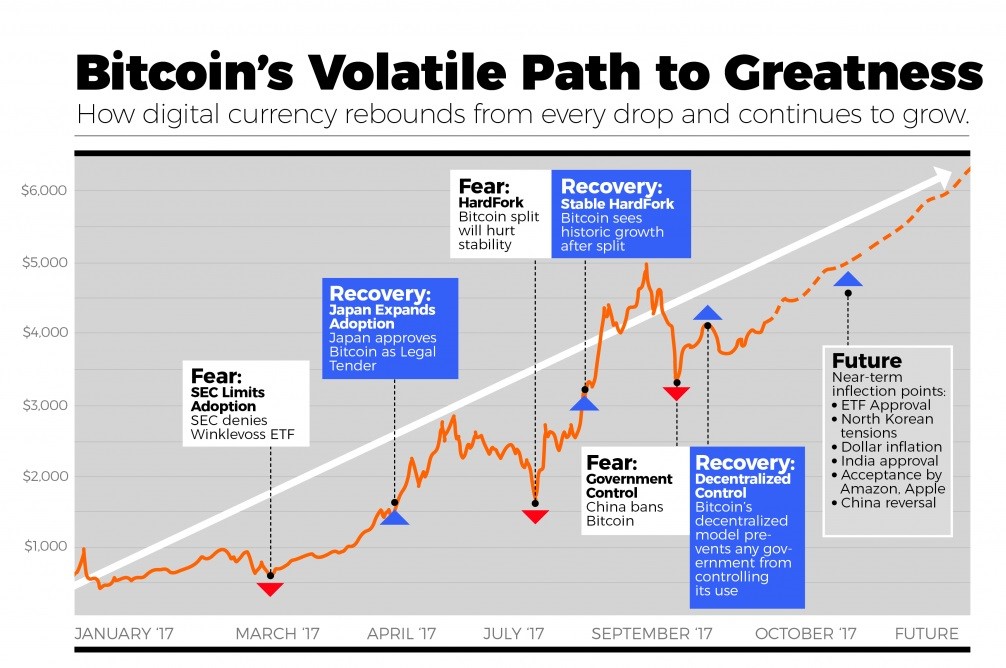

When Bitcoin surged from $1,000 at the start of 2017 to a record high of $17,000 in the month of December, there was a ton of speculation as to what was driving the surge. The application and possibilities of blockchain technology across industry and finance were one factor but that alone couldn’t drive such a huge surge. The underlying factors are known to many but rarely discussed in mainstream media. Luckily, if we compile data from multiple sources, a picture starts to emerge.

A picture of a fundamental lack of trust in Government, Big Business, and Big Money. Here’s why:

Data Security Breaches are becoming commonplace

In September of 2017, Equifax one of the largest credit reporting companies reported a cybersecurity breach. Although not an isolated incident, the Equifax breach was noteworthy because hackers made off with the credit data of over 143 million customers. To put things in perspective, that’s over ½ the population of the entire United States. Even more damning? Reports show that Equifax executives sold $2 million worth of stock within days of the breach. And then informed officials and the general public a month later.

A full month.

As infuriating as this case clearly is, it’s by no means an isolated incident. In July, hackers broke into the records of Verizon and made off with the records of 14 million subscribers and customers of the Bangladesh Bank lost $100 million to another cybersecurity breach. Statistics show two things: (1) These attacks are increasing in frequency which is hardly surprising given the growth in the volume of transactions and personal data stored online. (2) Although companies to their credit have made cybersecurity a top priority, they’re not doing a very good job; putting our hard earned money at risk.

Centralized Control of Currency is Dangerous

Most of us give international finance and big money hardly any thought – I included. Which is why it came as no shock for many to see so many big banks, finance pundits, and even governments come out so vociferously against Cryptocurrencies and Bitcoin in particular. There’s a reason for this and it’s something that the Big Business-controlled media will never openly admit to the fact that Bitcoin and Cryptocurrencies are disrupting the system and shifting the balance of power.

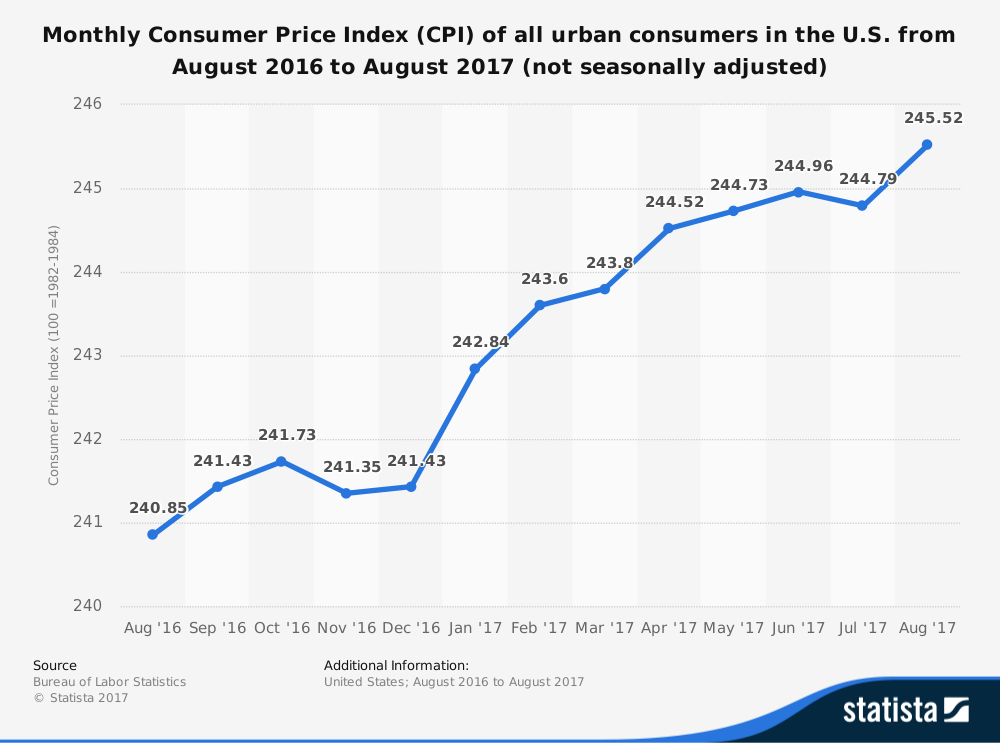

To explain further, first a quick lesson in economics: the dollar and other state-backed currencies called FIAT Currencies have a fundamental flaw in stroking inflation as wealth among the general population increases.

To elaborate simply, as more people come into wealth, they buy more. More purchases by so many reduce the supply of desirable goods and services which in turn forces merchants to increase the prices of said goods and services. As prices increase and more money is needed for purchases, the value of the individual monetary units decreases i.e. the purchasing power of the currency reduces. This is called inflation and it has a direct effect on the Consumer Price Index – a measure of the cost of living.

Although rare in the US, wild fluctuations in the value of state-backed currencies do happen. The Government, for example, can decide tomorrow to print additional currency notes which devalues existing currency and reinforces a higher cost of living on its citizens – as is happening right now in Venezuela and the Bolivar. In instances like these, the people are left with no recourse than to suffer or protest. Either way breeds mistrust in the government, banks and public officials.

Adding to this mistrust is the undeniable fact that both Governments, Banks and other financial institutions are run by people with vested interests. Vested interests that have a huge impact on our daily lives.

Case in point? If the government isn’t able to manage its debt or takes a wrong policy decision, the resulting fall out has major repercussions on currency valuations. Banks we know for certain have only their own interests at heart – the 2008 financial crisis was the most devious orchestrated looting of public wealth on record. And in the end, not only did no one goes to prison for putting the lives of millions of ordinary citizens at considerable risk, but we also gave them even more money so that their crippled, corrupt institutions could continue to stay in business (Too big to fail – Fannie Mae, Freddie Mac, Citibank??).

The People crave for Economic Stability

Given how much of economic instability can be laid at the feet of corrupt banks and governments, it’s no wonder that the appeal of Cryptocurrency has taken off since Cryptocurrencies like bitcoin are designed to be immune to the vagaries of economic turmoil and the influences of central authorities.

The result is a more robust store of value that cannot be influenced by banks, governments, and financial machinations. A store of value that gives power back to the people. Says Luis Cuende of Aragon:

“We don’t really need permission from banks or governments to move this forward. What’s going to happen is that people are going to start using Cryptocurrencies more and more and they’re going to self-organize and maybe self-govern. I think it’s pretty organic.

If you think about FIAT currencies, you see crazy changes in value because governments can print whenever they want to, but it happens the opposite with Crypto like Bitcoin. It can only grow in value – there is no other outcome at all.”

Chapter 3:

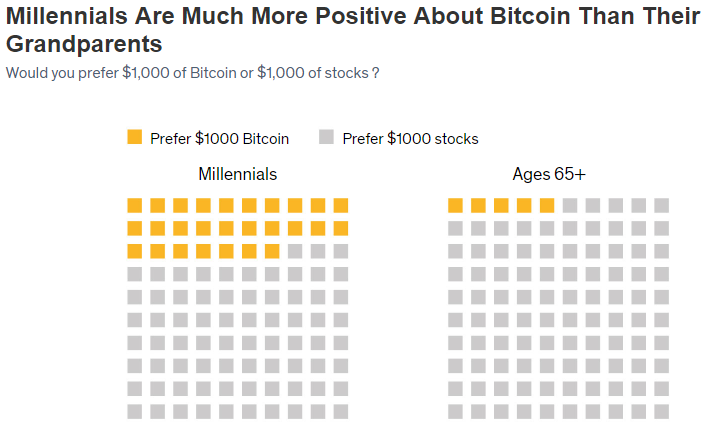

Why everyone from Millennials to Boomers is excited about Bitcoin

Imagine you were in your early 20’s in the year 2008. You watched in horror as the financial system imploded around you from years of shady deals & dubious financial practices. The job market dried up almost instantly as major banks imploded and your career prospects looked incredibly bleak at best. Given that you grew up with a smartphone with access to social media and the media, you slowly come to realize how corruption and collusion were at the heart of the economic collapse.

The entire situation left a truly bitter taste with the aftermath of recovery being truly horrid. Disillusion set in as the very perpetrators of the economic collapse – the banks – were bailed out by Uncle Sam, all without a single person ever going to prison for the colossal damage caused. These factors and more let to a permanent distrust of financial institutions, Big Money and any other form of centralized authority.

Now imagine one day you discover a new form of currency. Of wealth creation that is secure, transparent and free from the corruption and unreliability of the old financial system. Since Bitcoin and other Cryptocurrencies are decentralized, fully transparent and anonymous, it’s free from any form of ‘big brother’ interference. Users can verify transactions without the involvement of any middlemen (read banks). Also, fees are low and transactions can occur across national borders.

This sense of freedom meant that Millennials finally felt a sense of control over their money. A sense they never had during the reign of the old guard. Most Millennials viewed Cryptocurrencies as a hedge against future instability and a more secure way to save for education, retirement, and life. This outlook was one of the key factors in the rapid adoption of Cryptocurrency.

Boomers, on the other hand, took a more cautious approach, with many preferring to stick to conventional financial vehicles that to them, are tried and tested. Happily, though, that is changing.

As Josh “Downtown” Brown – a popular panelist on CNBC’s ‘Fast Money Halftime Report’ – put it “Someone who is 65 now, cannot afford to take all the risks of the table – particularly given that some of you can easily live till 95. If you think you’re going to fund a 30-year retirement with a Treasury Bond yielding 2% then you’re smoking crack. Never going to make it, never going to make it”

He went on to add “Like it or not, boomers are needing to learn to deal with volatility and take on more risk. You cannot just turn to all-cash bonds in your 60s anymore – given low-interest rates and longer lifespans.”

Today, we see that although lower in number compared to Millennials, a growing number of Boomers are raking in a tidy profit from Cryptocurrency purchases – both Bitcoin and lesser known ones.

Teeka Tiwari, Chief Investment Analyst for the Palm Beach Research Group says that this acceptance of Cryptocurrency is just the start of a massive wealth generation cycle for the American middle-class.

Says Tiwari “There are 700 other lesser known cryptocurrencies that smart investors are tapping into to experience life-changing profits. One of these little-known currencies has increased 22,000% in the past few years, and others have increased thousands of percentage points in mere months.”

For the sake of those just starting out in Crypto, here are 4 things you need to know about Bitcoin:

It’s currency built on a platform that’s owned by everybody

Just like email platforms – Yahoo, Gmail or Hotmail that are built by their respective companies on top of a mail platform, Bitcoin is built on a platform called blockchain that isn’t owned by any one corporation or entity. It’s a public system.

Cryptocurrencies remove the middleman

Every time you use your credit card to make a transaction, there are lots of middlemen that take a cut of the money before the merchant actually receives his payment. With Bitcoin, there is no middleman and so you don’t have to pay one.

There are risks

Bitcoin Alto more secure than traditional finance is susceptible to hacks. That being said, there are a lot of very smart people working to minimize that risk.

It’s volatile

Keep in mind that cryptocurrencies are a volatile investment with a lot of up and down movement. Before you put your money into cryptocurrency, it’s advisable to speak to an expert.

Chapter 4:

Bitcoin Essentials

How To Buy & Trade Bitcoin

Buying Bitcoin Locally:

An easy way to get your hands on Bitcoins is to access a local Bitcoin Network or community and buy currency from other users. Search apps cloud buyers and sellers to find each other with the intention of trading cash for Bitcoins. This is the way Bitcoins were intended to be traded since there’s no need to store your coins on a central server when you can just meet someone and buy coins from them directly. Alternatively, you can also purchase Bitcoins from Bitcoin ATMs. There are already hundreds of such special ATMs across the United States with much more coming online in the years to come.

Buying Bitcoin from a Clearing House:

So many of us, purchasing Bitcoin through a Clearing House like Coinbase is how we buy Cryptocurrency as and when needed. Clearing houses like Coinbase will always have Bitcoins available and they will even help you store them on your personal digital wallet – only charging a small 1% fee on every transaction. The only downside of purchasing Bitcoins through Clearing Houses is the loss of privacy and anonymity that can be enjoyed at the protocol level since you have to create a user profile that the clearing house will have on its record.

Buying Bitcoin from a Trading House:

For those people who look at Bitcoins as commodities to be bought & sold, buying Bitcoins can also be done on Bitcoin exchanges such as the Chicago Mercantile Exchange. Buying Cryptocurrency from these exchanges requires an understanding of how commodity trading works and usually requires an even higher level of individual identification – even more than clearing houses.

What is Bitcoin Mining?

According to Investopedia “Bitcoin mining is the process by which transactions are verified and added to the public ledger, known as the blockchain, and also the means through which new bitcoins are released. Anyone with access to the internet and suitable hardware can participate in mining. The mining process involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle. The participant who first solves the puzzle gets to place the next block on the blockchain and claim the rewards. The rewards, which incentivize mining, are both the transaction fees associated with the transactions compiled in the block as well as newly released bitcoin.”. This is how bitcoin mining works.

How the Price of Bitcoin is Determined

Before going further, a quick clarification: In this instance, ‘value’ is not to be confused with ‘price’ – which is the physical or monetary cost of buying Bitcoin. The price of Bitcoin being discussed here is the sum of a combination of factors outlined below:

Cryptocurrency like any other currency has value because the people who buy it is you it has some value. Bitcoin is unique because unlike other currencies that are backed by gold or other precious metals, Bitcoins inherit value is driven only by the value that people attach to it. The more valuable people think it is, the higher the price rises and vice versa.

The following points are some of the factors that influence the price of cryptocurrencies:

Limited Supply and supply/demand

There are only 21 million Bitcoins available for overall purchase. Unlike other forms of traditional currency, no more Bitcoins will be produced making what is available highly sought after.

Energy put in the form of electricity to secure the blockchain

Mining Bitcoins requires a considerable amount of energy which will only increase as the number of Bitcoins that can be successfully mined becomes fewer and fewer in number. The higher the energy consumption to mine Bitcoin, the higher the price.

Blockchain difficulty level

The more secure the blockchain, the higher the mining difficulty and a subsequent effect on price.

The utility of the currency, and how easy it is to use and store

A currency has value because it can be used to purchase goods and services. Right now this utility for Bitcoin is in its infancy but, it is growing. The more Bitcoin can be used to pay for goods and services, the higher it’s perceived value.

Perceptions of its value by the public

The biggest factor that affects the value of Bitcoin is public perception. The more people perceive it to be valuable, the higher the price. This public perception is influenced to a large degree by the media and information found online.

Confidence in traditional systems

As we’ve discussed earlier, the lack of trust in traditional financial systems is a big contributor towards the higher price of Cryptocurrencies.

Chapter 5:

Retirement & Bitcoin

How Bitcoin can prevent the looming Retirement Crisis

For those of you with a retirement fund, you are already ahead of the game. Research has indicated that nearly 40% of Americans haven’t saved anything for retirement according to the National Institute on Retirement Security. Chances are though, your retirement fund could do with a boost.

It is universally agreed upon that to maintain your current standard of living in retirement, you must save at least 11 times your income by the age of 65. Most Americans don’t come anywhere close to that figure, as workers are simply not saving enough. This lack of financial security is putting a tremendous strain on Medicare and Social Security. Case in point: in 2017 Social Security paid out only $1,316 a month and government figures have indicated that Medicare will be completely depleted of funds by 2028. A lot of experts agree that the next economic quagmire that America will face is the Retirement Crisis.

It’s providential then that the rise of cryptocurrency has come at the right time offering investors a new option of generating wealth. And since Bitcoin is not tied to any government policies or financial assets, it’s able to provide a higher rate of return and security beyond what traditional assets can offer. The Millennial generation – already burdened with high student debt and a depressed economy post the crash in 2008, are turning to Bitcoin in droves in order to at least guarantee their retirement. Given that Bitcoin has grown by 1300% in 2017 alone while other traditional investments have remained stagnant shows that it’s a prudent choice for long-term Investments.

Here’s everything you needed to know about adding digital currencies to your retirement portfolio:

- You can easily convert your current IRA or 401K into a Digital Currency IRA. The process is simple & easy.

- A Bitcoin IRA is like any other retirement account – you make regular tax advantage to contributions to an IRS recognized retirement account that is set-up and administered by a custodian or managed yourself (SDIRA). The only difference is that rather than investing in traditional investments like stocks, your investments are in Cryptocurrencies like Bitcoin.

- IRS recognizes Bitcoin as a property rather than a currency.

- Your Bitcoin IRA is subject to the same rules as a traditional IRA, Roth IRA or a company sponsored 401k.

- Bitcoin has consistently been able to deliver incredible returns on investment in just a few years. Returns that have been for more than traditional stocks and other investments have been able to do – upwards of 1000% in a single year!

- Since Bitcoin and other cryptocurrencies are not pegged against the dollar they can act as a hedge against inflation. Also, since it is not controlled by any Central authority it is immune from the effects of manipulation and influence.

- Bitcoins underlying Technology the blockchain of a state of the art security against hacks and other forms of cyber security threats.

By removing the middleman i.e. Banks, Bitcoin and other Cryptocurrencies give you back total control of your OWN money. No more limits on withdrawal, no more unnecessary fees, and surcharges.